Donor-Advised Funds: Should You Give Through a DAF Account?

Fewer headaches. Lower costs. Smarter tax strategies. Learn why donors are flocking to DAFs.

Do any of these scenarios describe you?

- You’re serious about giving but wary of the challenges of running a private foundation—especially the costs and time commitment.

- You’d like the flexibility to fund your charitable contributions with a wide variety of assets, including stock and real estate.

- Recent changes in tax law have eliminated the benefit of itemizing your donations. You’d like to find a new giving strategy to get your tax breaks back.

- You want to get more involved in giving but could use help from an experienced adviser.

If so, you may be a good candidate for launching a donor-advised fund, or DAF for short. Find out why this simple giving vehicle has exploded in popularity in recent years, and how it might help you reach your charitable goals.

What Is a Donor-Advised Fund?

A donor-advised fund is a special account for managing and distributing charitable donations. It’s a bit like a charitable savings account, only instead of making withdrawals from the account for your personal use, you recommend grants for nonprofits you care about.

Here’s how the process of giving with a DAF generally works.

Step 1: Choose a sponsor organization and open your DAF account

You might select a national sponsor organization such as Fidelity Charitable or the National Christian Foundation. You could also choose a community foundation active in your area, or a single-issue sponsor aligned with a cause of your choice.

There are typically no set-up costs for starting an account, and the process is as easy as opening a brokerage account.

Step 2: Make a contribution

You can make a contribution of cash, stock, real estate, or other eligible personal assets. You can even donate an interest in a business. Once given, this contribution can’t be revoked; it belongs to the fund.

Step 3: Receive your full tax benefit immediately

You get to deduct the full eligible amount of your contribution to the DAF in the year in which you make it—regardless of when the fund actually disburses any grants.**

Step 4: Invest your assets and potentially grow them tax-free

Depending on your sponsor organization, you’ll likely be able to recommend an investment strategy, or select from a menu of investment options. Your sponsor may also provide an adviser to guide you on this. But remember, because the assets belong to the fund, the sponsor has final say on investment decisions.

Once the fund’s assets are invested, any growth is not taxed.

Step 5: Recommend grants from your account whenever you choose

When you wish to recommend a grant to a legally recognized nonprofit, simply submit a request to your sponsor organization. Take note: grants can’t go to an individual or be used for something of value to the donor, such as a table at a fundraising event.

Again, the sponsor ultimately controls the fund’s assets and must authorize all distributions. But in practice they typically issue grants according to the donor’s recommendations, if legally permissible. That’s what makes it a “donor-advised” fund.

Why Give Through a DAF?

Flexibility

One clear advantage of a donor-advised fund is its flexibility, which is built right into its structure. The donor gets an immediate tax write-off for the full eligible amount of the contribution.** Yet they can actually disburse the funds whenever they wish. It’s also easy to divide their grants among different organizations as they choose.

Convenience and Cost

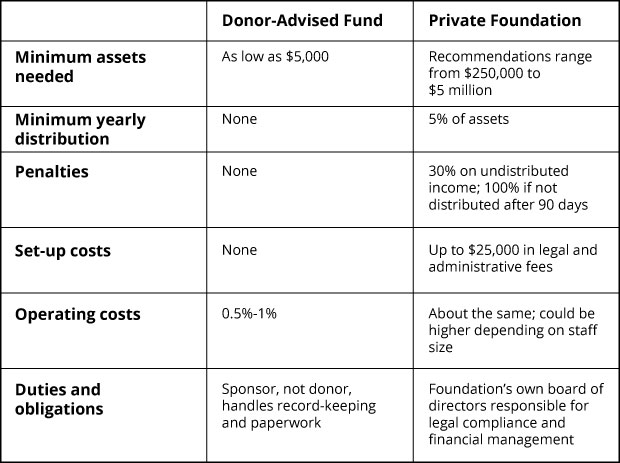

Many donors choose DAFs because of how easy and inexpensive they are to establish and run, especially compared to a private foundation. This chart illustrates the dramatic differences between the two.

Of course, private foundations have their advantages too. For example, DAFs may require donors to cede more control of their assets than a foundation might. Please consult your financial adviser for more on the differences between DAFs and private foundations.

Tax Advantages

The assets in a donor-advised fund are allowed to grow tax-free, making them a tax-efficient place to host investments you wish to give away. But there’s another tax-related reason for starting a DAF, one that explains why these accounts have become so popular in recent years.

According to the National Philanthropic Trust, the number of donor-advised funds grew 167% from 2015 to 2018. The timing isn’t a coincidence. In 2017, a major federal tax law doubled the size of the standard deduction for many taxpayers.

One side effect of this change was to reduce the tax benefit of giving to charity directly. That’s because you can only write off a charitable donation if you itemize your deductions. If Congress raises the standard deduction, it might not be worth it to itemize your taxes anymore. So, no more write-offs.

But donor-advised funds change the math. For example, say you expect to give $5,000 to charity each year for the next 3 years. Now imagine that instead, you gave $15,000 to a DAF this year, then disbursed that money in grants from the account over the next 3 years.

In practice you wouldn’t be changing your charitable giving much; you’d still be distributing $15,000 over the next 3 years. But now you’d be able to deduct the full eligible amount in a single tax year, which may make it worthwhile to itemize instead of taking the standard deduction.** Your write-offs are back.

This strategy is called “bunching,” and it’s a major reason why donor-advised funds have grown so dramatically since that tax-code change in 2017.

Other Benefits of DAFs

- Simplicity. Access your account online any time. Recommend grants in a few clicks.

- Privacy. You may be able to choose whether your grant includes your name or not.

- Broad access. You don’t need to donate millions of dollars to become more serious about philanthropy.

- Family legacy. Name successors to your fund and get your family involved in your giving.

- Education. Sponsors may offer resources and advice that help you clarify your goals and improve your giving strategies.

How to Recommend a Distribution to Kinship United

Already have a donor-advised fund? Recommending a grant to Kinship United is simple. Just search for your sponsor organization from our list. If you have any questions, please have your financial advisor contact us.

How DAF Giving Supports Kinship United’s Mission

Your grant enables Kinship United to support nearly 50 Kinship Projects in 10 countries around the world. Led by indigenous pastors, these church homes provide long-term safety and peace for vulnerable widows and orphans. Your donation helps these Kinship Projects serve their communities as relief centers, water sources, feeding programs, schools, medical clinics, and more. Read more about Kinship United’s mission.

**Other limits, such as the percentage of your adjusted gross income you may deduct for charitable donations, still apply.

Kinship United often posts content and opinions that are of interest to the philanthropic community that supports Kinship United’s mission. Nothing published by Kinship United constitutes an investment recommendation, nor should any data or content published by Kinship United be solely relied upon for any investment, tax, legal or financial decisions. Kinship United strongly recommends that you perform your own independent research and/or speak with a qualifying investment professional before making any financial decisions.

Page published May 20, 2020